Research - 17.03.2022 - 00:00

Swiss Mobility Monitor 2022: Emotions drive the decision for new forms of mobility

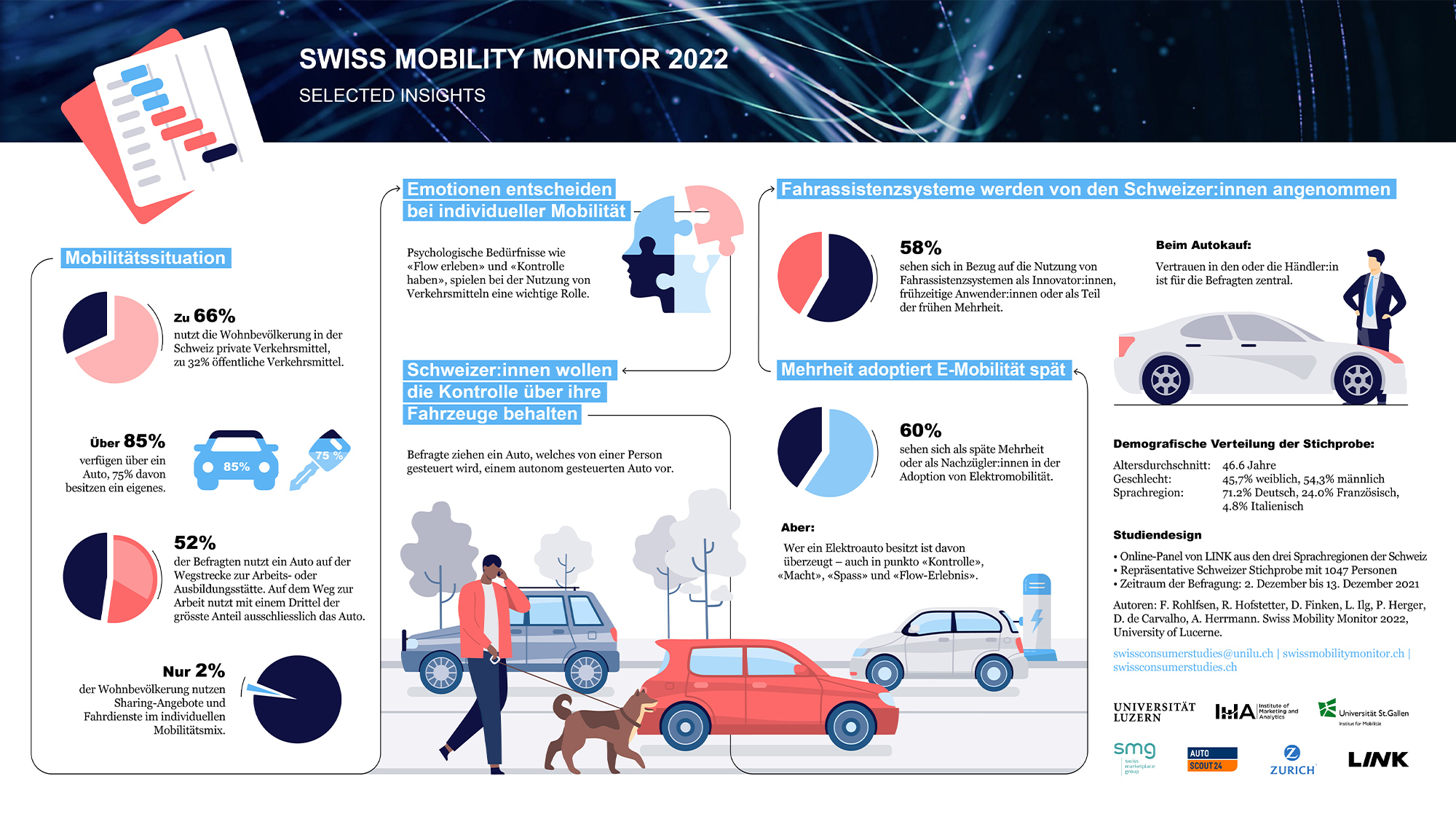

A representative study by the Lucerne and St.Gallen (HSG) universities highlights the status of new forms of mobility in Switzerland and to what extent motives and needs influence acceptance and use.

Source: HSG Newsroom

17 March 2022. The “Swiss Mobility Monitor” released today focuses on motives and needs which are deterring the population living in Switzerland from using new forms of mobility, or perhaps even encouraging them. The study is the result of a representative capturing of data, carried out for the first time in Switzerland, which arose under the academic leadership of Prof. Dr. Reto Hofstetter (University of Lucerne) and Prof. Dr. Andreas Herrmann (University of St.Gallen).

The Swiss Mobility Monitor 2022 was implemented in collaboration with the Institute for Mobility at a the University of St.Gallen, Zürich Versicherung and AutoScout24. For researchers, the findings offer a basis for further projects, and for marketing and sales experts, it also offers specific starting points to develop strategies for future marketing of mobility innovations such as electric vehicles, car-sharing or multi-modal mobility options – which is the option to use several forms of mobility for one journey.

The private car dominates – car-sharing is less widespread

The Swiss Mobility Monitor 2022 illustrates that the population living in Switzerland currently uses mainly classic forms of transport: Public transport is used for a third of distances covered and the remaining two thirds of journeys are undertaken almost exclusively using a private car. Car-sharing has so far been less widespread, however 10 per cent of those surveyed plan to use car-sharing offers in the coming 12 months. Sharing opportunities will become increasingly important in the coming years. In comparison to sharing opportunities, multi-modal mobility offers have actually been well-received in Switzerland already: around 50 per cent of those surveyed are already using these today for the journeys travelled.

Selected Insights

Choice of mobility is emotional

Further results confirm that mobility is often a very emotional topic. The fundamental consumer motives such as fund, "flow", control and power are shaped differently depending on the form of transport. The opportunity to get into a "flow", in other words having the feeling of losing your sense of time while travelling, as well as feeling that you have control over your chosen form of mobility, is an important factor when choosing a form of transport. This is also noticeable in the new forms of mobility: For example, those surveyed tend to link the experience of a flow moment and the exercising of control more to a vehicle with a combustion engine rather than one with an electric engine.

Perhaps this is also why the population has so far still been somewhat reticent about adopting electromobility. However, when it comes to groups of people who already own an electric car, the mobility motives show a contrasting picture: the electric car owner subgroup explain that they perceive that the need for control, power, fun and flow is much better met with their cars than those with combustion engines. Professor of mobility Andreas Hermann adds: “You simply have to try electromobility yourself to like it.”

When it comes to the use and acceptance of car-sharing offers or autonomous vehicles, motives like control, flow and fun factor still play a crucial role: It is the main reason for the majority of those surveyed being less convinced by car-sharing offers or autonomous vehicles and tending more towards private self-driven vehicles. Here, too, there are interesting differences based on personal mobility behaviour: people who already use new forms of mobility such as car-sharing offers tend to have a more positive attitude towards new forms of mobility.

Digitalisation in the vehicle trade is less noticeable

Digitalisation and online trade have only made a minimal impression on the vehicle trade to date: fewer than 7 per cent of the study participants state that they have bought a car online. 88 per cent of those surveyed plan to look for conventional car dealerships when buying a car. In contrast with trends in other sectors, trust in sellers when buying a car plays a crucial role: results show that the population of Switzerland places more trust in the classic, bricks and mortar car trade – in comparison with online trade – when it comes to purchasing cars.

The summarised results of the study can be retrieved via the Swiss Consumer Studies website. The data set from the Swiss Mobility Monitor is a representative online survey for Switzerland of 1,047 people living in Switzerland over the age of 18. The data was captured between 9 and 15 December 2021 in cooperation with LINK. The Swiss Mobility Monitor is part of the Swiss Consumer Studies at the Institute of Marketing and Analytics (IMA) at the University of Lucerne. Swiss Consumer Studies releases studies on current topics on digital consumer behaviour and digital marketing at regular intervals.